How it all started

About Parkwalk

In 2009, Parkwalk’s founders saw a gap.

Groundbreaking ideas were coming out of the UK’s universities. World-class research, years in the making. But too often, they stalled due to lack of funding. They were hard to value, hard to back, and even harder to scale.

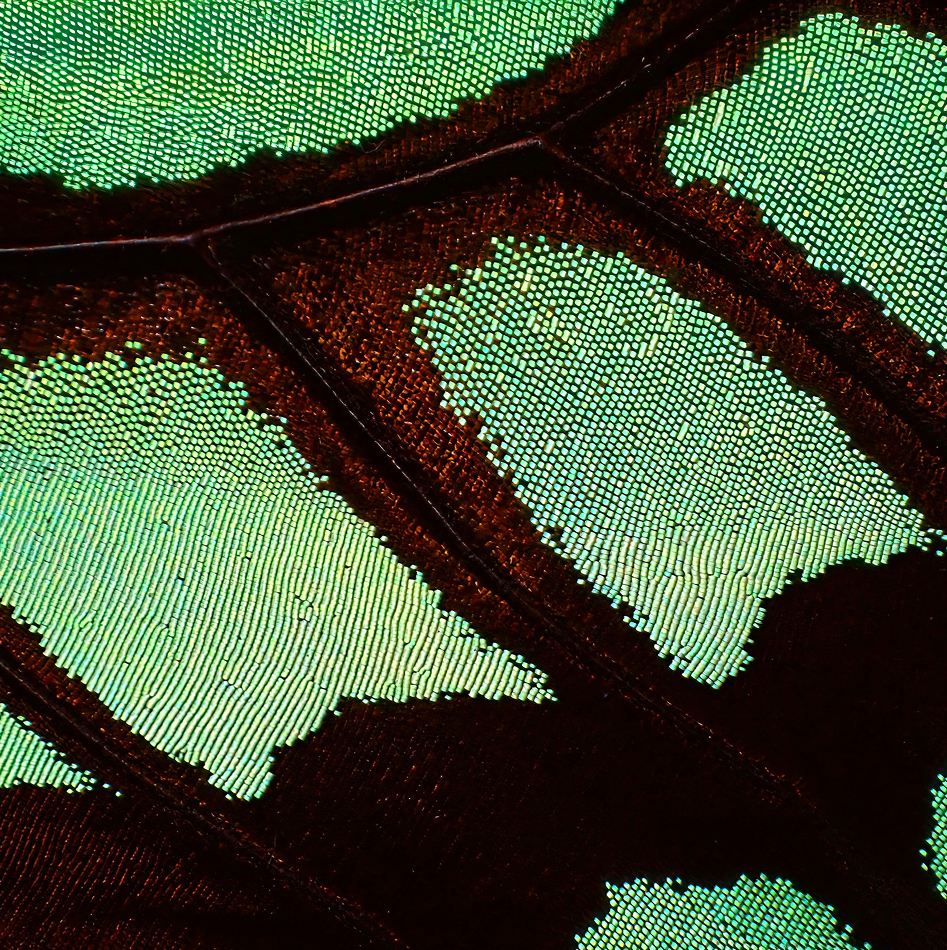

Meanwhile, the UK’s university tech transfer offices were becoming more professional, opening clearer paths from lab to market. With four of the world’s top ten universities and breakthroughs like Graphene at Manchester University, DNA at Cambridge, Fibre Optics at Imperial, and LCD screens at Hull. The ideas were there. They just needed the capital and support to grow. So we built something new.

Parkwalk was created to bridge the gap between academic innovation and commercial success. To turn world-changing research into world-leading companies across medicine, engineering, genetics, and computer science. In 2017, Parkwalk joined forces with IP Group plc and today, we’re the UK’s most active investor in university spinouts.

Universities are pools for talent and innovation

University Spinouts

Universities are more than labs and lecture halls. They’re hubs of talent, collaboration and multidisciplinary thinking. The companies we back are born from years of research funding and grant support, generating groundbreaking IP, giving them a head start and a stronger chance of success.

Through trusted partnerships with leading universities, we have direct access to the UK’s most exciting ideas — and the unique opportunity to back them early.

Our track record

Data as at December 2025

Exited examples

Yasa

- Acquirer

- Mercedes-Benz

- Year

- 2021

- Exit Multiple

- 2-6x return to investors*

PetMedix

- Acquirer

- Zoetis

- Year

- 2023

- Exit Multiple

- 1.5-8x return to investors*

Cytora

- Acquirer

- Applied Systems

- Year

- 2025

- Exit Multiple

- 1.7-13.8x return to investors*

*Does not include EIS tax reliefs or fees. Data as at December 2025. Past performance is not a reliable indicator of future returns.

FAQs

Why was Parkwalk founded?

Parkwalk was founded to connect investors with high-growth, UK-based startups through EIS and VCT funds. Focused on knowledge-intensive sectors like technology and life sciences, it has built a diverse portfolio of early-stage companies while helping investors access tax-efficient opportunities.

What is Parkwalk's track record?

Our multi award-winning Opportunities EIS Fund has established a successful track record for returning cash to investors. The Fund aims for capital growth by investing in knowledge intensive technology companies that have defensive intellectual property (IP), that has spun-out from UK’s leading research institutions and top universities nationwide.

Why does Parkwalk focus on university spinouts?

We believe world-changing ideas often start in universities. These spinouts are founded on years of research and protected intellectual property (IP), giving them a strong platform for commercialisation. Parkwalk’s mission is to help those ideas grow into successful, globally impactful businesses.

How many companies has Parkwalk backed?

We’ve invested in more than 200 university spinouts to date, with over 70 exits and £200 million+ returned to investors — making us the UK’s most experienced spinout investor.

Can individuals invest directly with Parkwalk?

Yes. UK investors can access Parkwalk’s EIS funds directly, benefitting from tax-efficient exposure to a diversified portfolio of cutting-edge British university spinouts. Learn more on our Funds page.

Our People