Investing in Innovation

Backing world-changing deeptech companies emerging out of UK universities. We bridge the gap between academic innovation and commercial success, empowering university spinouts to create a global impact.

What is a university spinout?

The UK’s most active investor in university spinouts

About Us

At Parkwalk, we understand the transformative potential of deeptech innovations born from the UK’s world-class university research.

We have over 15 years’ experience nurturing groundbreaking ideas into successful, impactful businesses. And we know that converting pioneering research into commercial innovations takes unwavering commitment and support.

That’s why we partner with the boldest, most visionary university spinouts, providing the funding, expertise, and networks they need to thrive. As a leading EIS fund manager, we offer investors tax-efficient opportunities to support these groundbreaking ventures.

Access excellence, invest in impact

Sectors

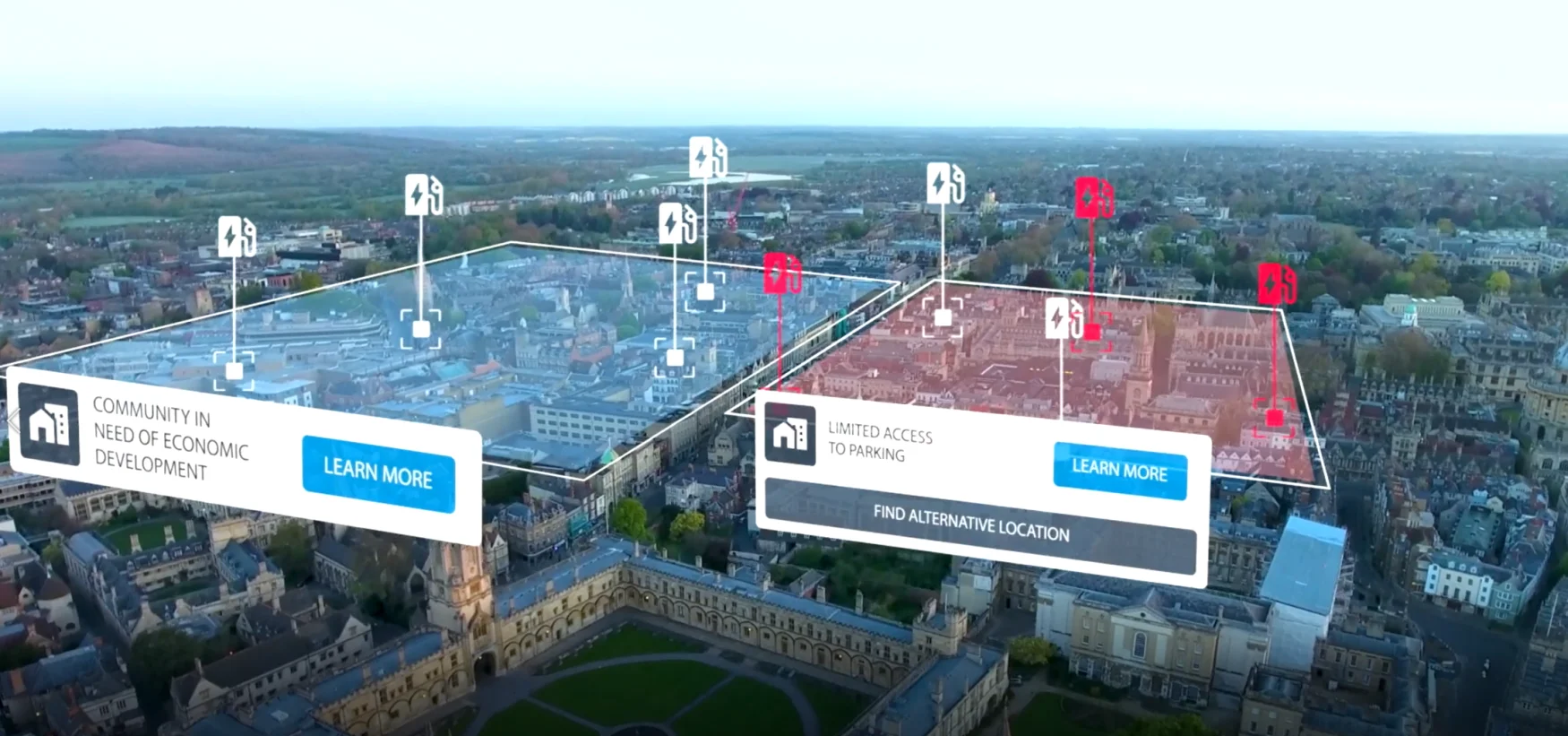

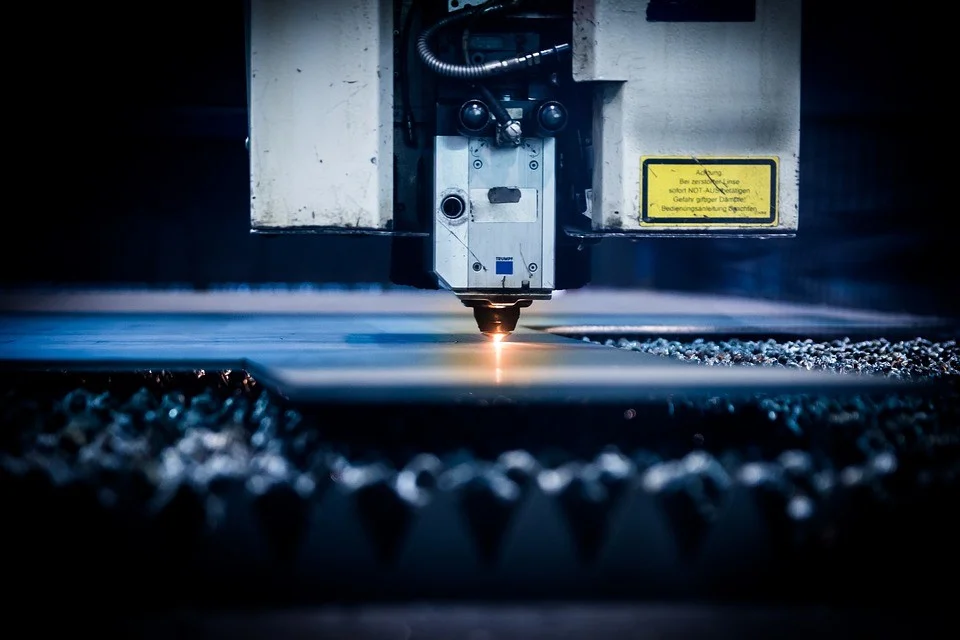

Across our three core sectors, we unlock the power of UK university research to create a future shaped by the impact of deeptech. We have backed over 200 companies across sectors including AI, Quantum Computing, Hardware, Cleantech, Digital Health, Life Sciences and more.

Academic brilliance

Commercial triumph

Partners in innovation

Catalysts for growth

From lab to market

Investment Strategy

Parkwalk bridges the funding gap between early academic discovery and later-stage venture capital. We invest across the spinout lifecycle – from seed to scale – helping turn pioneering research into commercial success.

As part of IP Group plc, we back companies from start-up to scale-up, with a proven record of delivering consistent investor returns.

From academic brilliance, to commercial success

Where university innovation meets investor opportunity

Team

With over 160 years experience, the investment team is well versed in all things venture capital and M&A.

Latest from Parkwalk and our portfolio

Phasecraft announce $34m Series B funding round

Opsydia closes pre-Series A funding round